1、Digital Trends in the Financial Industry

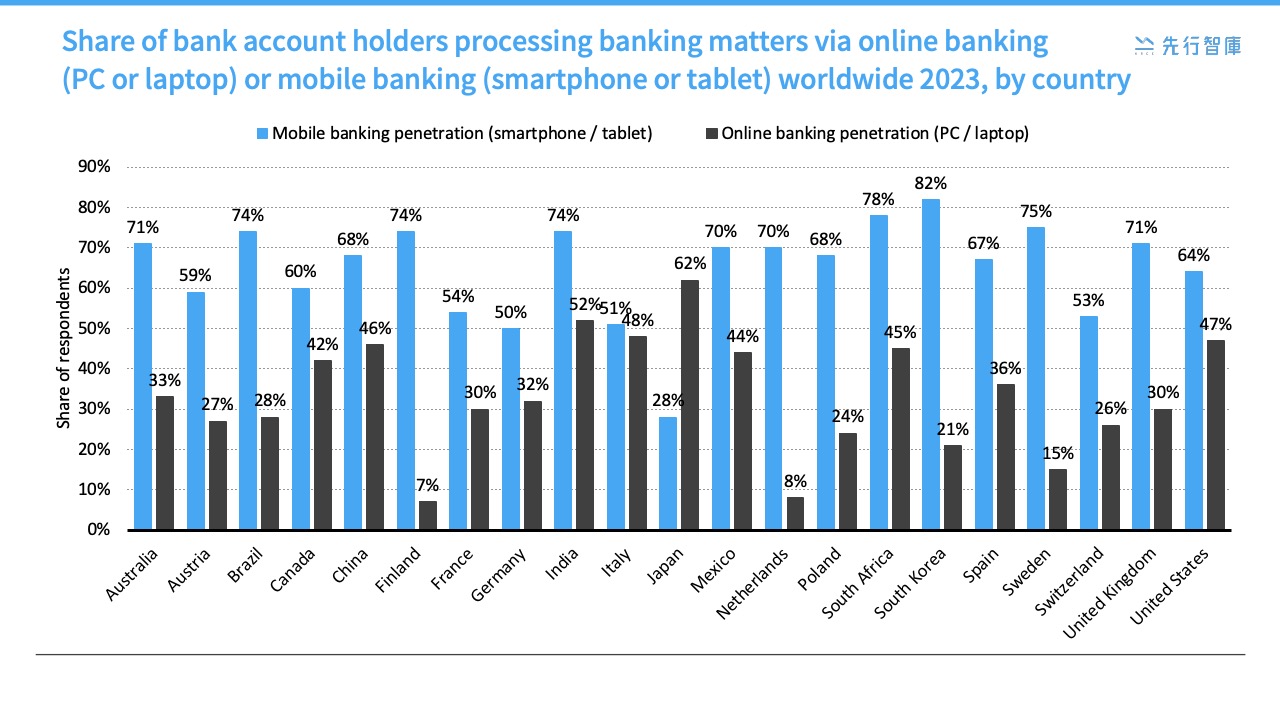

According to the latest consumer survey by Statista, in 2023, Japan led the world in internet banking usage in finance at 62%, while South Korea dominated mobile banking usage in finance at 82%. This highlights the widespread adoption of smart devices for financial services in Asia. Meanwhile, internet banking in finance is also commonly used across Europe (Switzerland, Poland, the Netherlands, France), contrasting with the mobile banking trend in finance in Asia (South Korea, India) and Latin America (Brazil, Mexico).

Driven by the digital wave, Taiwan’s financial sector is swiftly catching up in data analytics. A report by the Taiwan Academy of Banking and Finance indicates that 90% of local banks have initiated digital transformations, with 30% assessing their progress as more than halfway complete. This underscores a significant increase in focus on internal IT departments in Taiwan’s financial industry and a critical demand for data professionals across departments, vital for maintaining competitive edge. However, there are still challenges to overcome in pushing data initiatives in the financial sector. This article will continue to explore the challenges faced by Taiwan’s financial industry in data analytics and management, offering key pain point analysis and feasible solutions.

2、Pain Points in Finance Data Analysis

Pain Point One: Massive data volumes make Excel cumbersome.

Data departments often provide various datasets via Excel, including bank transactions, credit card activities, financial markets, credit scores, and product sales. However, these Excel files typically contain huge amounts of data, sometimes exceeding hundreds of thousands of entries per day with file sizes over 10MB. Due to hardware limitations and Excel’s own constraints, merging daily data for analysis often leads to system crashes or files failing to open.

Pain Point Two: Similar data types stored across disparate systems, complicating management and integration.

Companies typically operate multiple systems (e.g., internal document management, stakeholder systems, risk assessment systems) with similar types of data stored in different locations. Integrating data for analysis requires extracting from various systems, often involving multiple login credentials, which poses a risk of being forgotten. After successful login, generating and downloading reports under varying conditions to consolidate data from multiple systems becomes necessary. Additionally, logic definitions, such as account opening information, might differ between systems, making the manual adjustment process time-consuming.

Pain Point Three: Using Excel limits multi-dimensional cross-comparative analysis.

During data analysis, multi-dimensional comparisons are often necessary. Using Excel for this purpose requires generating numerous reports for cross-referencing, which is inefficient for achieving desired outcomes.

3、Application of Power BI in Financial Data Analysis

As Taiwan’s financial sector rapidly digitalizes, Power BI—a robust business intelligence data analysis tool from Microsoft—is well-equipped to tackle the three mentioned pain points in financial data analysis.

- Power BI is specifically designed for large data analysis, capable of handling datasets that Excel cannot open.

- Power BI can centralize data scattered across different systems and platforms, similar to adding a multifunctional indexing system to your office. It connects to various databases like SQL Server, MySQL, Oracle Database, and supports commonly used file types such as CSV, TXT, and XLSX. In practice, financial information units may not allow direct database connections to avoid overload issues. If a data mart or data warehouse has already consolidated multiple databases, then connectivity becomes more feasible.

- Power BI’s charts enable cross-filtering and complex formula calculations for anticipated analysis outcomes. Advanced features of Power BI can also address inconsistencies between datasets.

In today’s data-driven economy, with the capabilities of Power BI, Taiwanese financial institutions can confidently face data analysis challenges, enhancing internal operational efficiency, driving business innovation, and increasing competitiveness and market leadership while safeguarding customer privacy and corporate secrets.

KSCC is a management consulting company in Taiwan. Our services include corporate in-house training, consulting, and leadership management.For more information about our corporate services, please feel free to visit our website: https://kscthinktank.com.tw/custom-training/