Outline

Introduction to Thailand’s electric vehicle market

Statistical data analysis of Thailand electric vehicle market

KSC Insight and Suggestions

1. Introduction to Thailand’s electric vehicle market

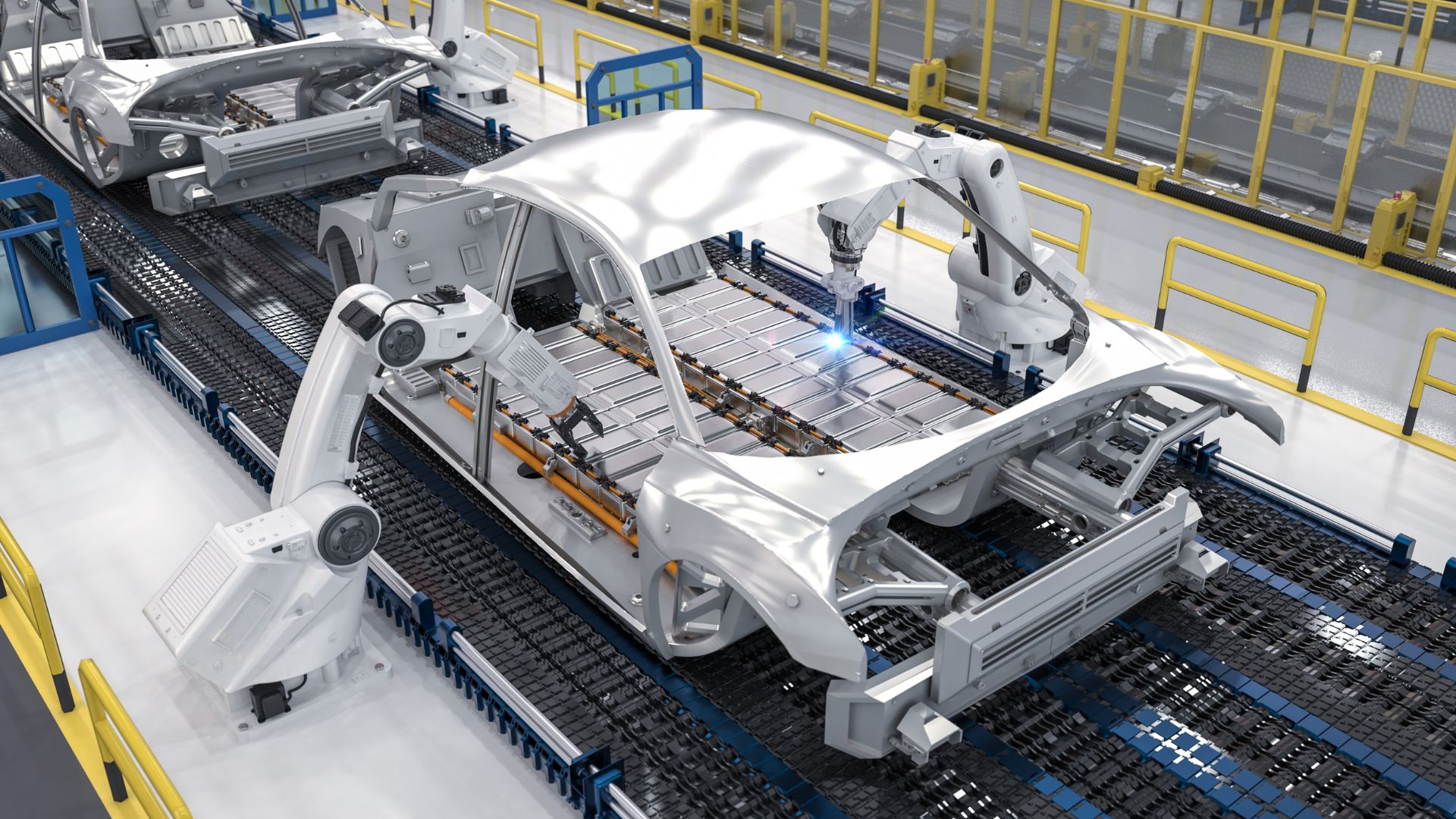

Thailand’s electric vehicle (EV) market is still in its infancy, but has the potential to grow significantly in the future. The Thai government has set ambitious targets for the electrification of transportation in the coming years and has implemented several incentives and policies, such as exemption from consumption tax, to support this goal. The country aims to produce 100% battery electric vehicles (BEVs) for domestic sales by 2035.

Thailand has become the leading EV market in Southeast Asia

Thailand is a major hub for the production and assembly of internal combustion engine vehicles in Southeast Asia. The manufacturing sector is a major contributor to the country’s GDP, so it is crucial for Thailand to maintain its position in the region. Although the EV market in the region is still relatively small, Thailand dominated the Southeast Asian EV market in terms of sales share alone in 2022, making it the most important market for EV automakers in the region. From 2018 to 2021, the number of EV registrations in Thailand increased steadily, and the value of the Thai EV market is expected to nearly double by 2025.

Who will dominate the domestic market?

BEVs produce zero emissions, making them an attractive alternative to conventional petrol and diesel vehicles. In contrast to BEVs, hybrid electric vehicles (HEVs) have an internal combustion engine in addition to an electric motor. Currently, the number of HEVs on the streets of Thailand is much higher than that of BEVs, as consumers are still concerned about the lack of charging stations across the country. However, in 2022, the sales growth of BEVs in Thailand was much higher than that of HEVs, with an increase of more than five times.

In order to make a successful transition from a country that relies primarily on ICE vehicles to a country that primarily uses BEVs, the development of a robust charging infrastructure is essential. In 2022, Chinese OEMs such as Great Wall Motor (GWM) and BYD launched new, affordable EV models that offer BEVs at very competitive prices compared to the high-end models already available on the market.

2. Statistical data analysis of Thailand electric vehicle market

Thailand’s dominance in the electric vehicle market in Southeast Asia is clear. In the third quarter of 2022, its market share reached 59%, more than double that of its closest competitor. Strengthen investment in the Thai market, especially in marketing and branding, to consolidate and expand market share.

From 2016 to 2022, the market value has experienced significant growth, from $500 million to $15.8 billion, demonstrating the strong potential and growth momentum of the market. Further investment should be made in market research and consumer demand analysis to better grasp market trends and opportunities.

In 2022, HEVs outperformed BEVs and PHEVs, with 41,927 units sold, compared to 10,203 BEVs, indicating that the market acceptance of different types of EVs is different. The market visibility of BEVs and PHEVs should be improved, and the distribution of sales should be balanced through policy support and marketing. In 2022, BEV sales increased by 539% year-on-year, showing that the market has a high interest and demand for pure electric vehicles, which can increase investment in the BEV field and develop more innovative products to meet market demand.

Key concerns include the high price of electric vehicles (37%) and inadequate charging infrastructure (35%), which are factors that may hinder the market growth. Addressing key consumer concerns by reducing EV prices and improving charging infrastructure.

With a 42.7% share of the market, the Ora Good Cat is the most popular BEV, followed by the MG EP (17%) and the Volvo XC40 Pure Electric (13.8%). Gain insight into the success factors of market-leading models, and adjust and optimize product strategies based on these insights.

3. KSCC Insight and Suggestions

To help the company succeed in Thailand’s EV market, KSC offers three key strategic actions:

Deepening marketing and brand building:

Considering the increasing competition in Thailand’s electric vehicle market, companies should increase brand awareness through effective marketing strategies. This may include digital marketing, participation in industry fairs, and collaborations with local partners. It is important to understand the specific needs and preferences of Thai consumers and to take these factors into account in your marketing campaigns. In addition, building a strong customer service and support system will also help drive brand loyalty.

Enhanced product diversity and price competitiveness:

Given the demand for different types of electric vehicles in the Thai market, companies should consider launching a range of products, ranging from high-end to low-mid-range, to cover different market segments. This includes developing more affordable models to appeal to price-sensitive consumers. At the same time, attention needs to be paid to the performance and quality of the product to ensure compliance with the local environment and road conditions.

Strengthen investment and cooperation in charging infrastructure:

Considering that inadequate charging infrastructure is a major obstacle to EV adoption, companies should actively work with local governments, energy companies, and other relevant agencies to invest in building and maintaining charging networks. This includes setting up fast charging stations in key locations, as well as providing charging solutions for homes and offices. At the same time, companies can consider providing technical and financial support for the construction of charging stations to accelerate the development of infrastructure.

These strategic actions will help the company more effectively enter and expand the electric vehicle market in Thailand and address current and future market challenges.

KSCC is a management consulting company in Taiwan. Their services include corporate in-house training, consulting, and leadership management. For more information about their corporate services, visit: https://kscthinktank.com.tw/custom-training/